The Federal Reserve Note are simple U.S. dollar bills and the official currency of the United States. These notes represent the paper money issued by the U.S. Treasury. The Federal Reserve, the central banking system of the United States, backs them. As you explore Federal Reserve notes, their purpose, and history become prominent. That is how they form the backbone of the U.S. economy and the global financial system.

What is a Federal Reserve Note?

A Federal Reserve note is the paper currency the U.S. Federal Reserve issued. It is a promissory note, meaning it is a legal tender for all debts, public and private, in the United States. While it may look like simple paper money, it holds immense value in the U.S. economy and the global financial system.

Key Features of a Federal Reserve Note:

Federal Reserve Notes are now the official currency in the U.S. issued by the Federal Reserve. These notes are considered very valuable because of their unique features from other paper notes.

Denominations:

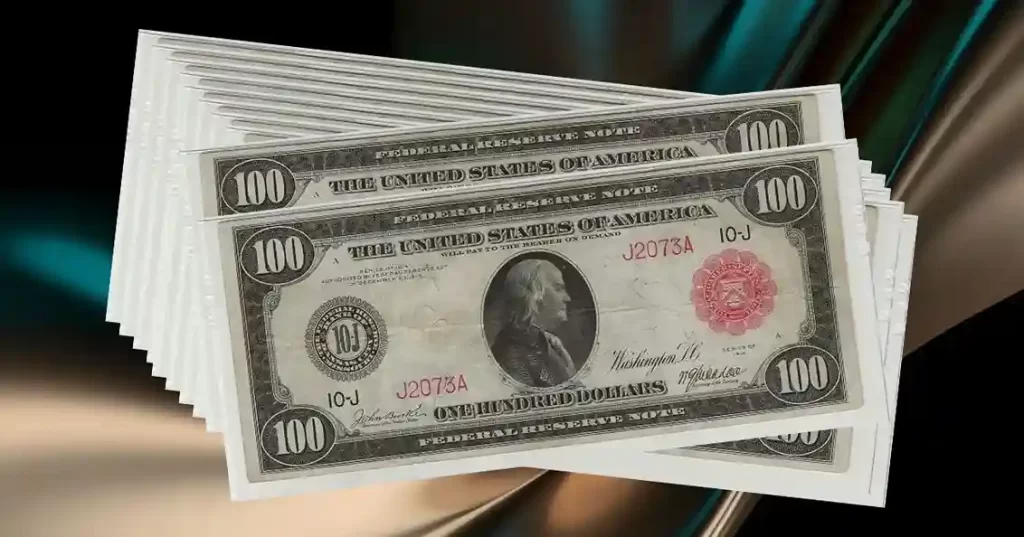

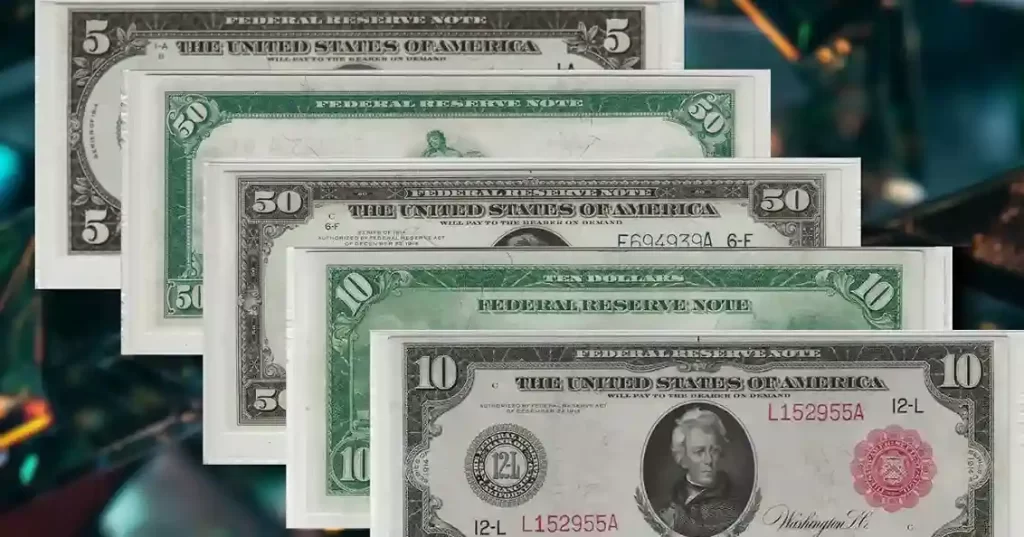

Federal Reserve notes are issued in different denominations, including $1, $5, $10, $20, $50, and $100 bills.

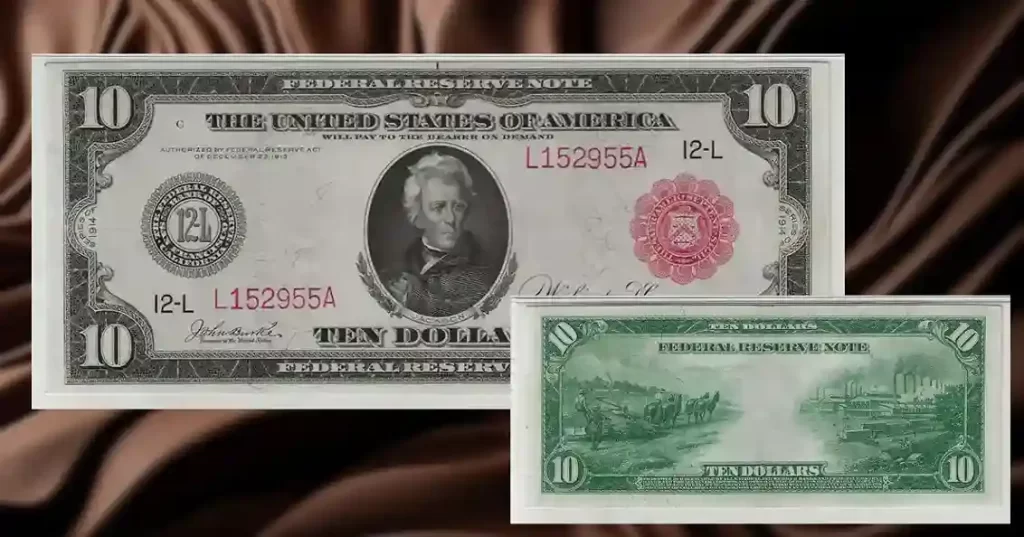

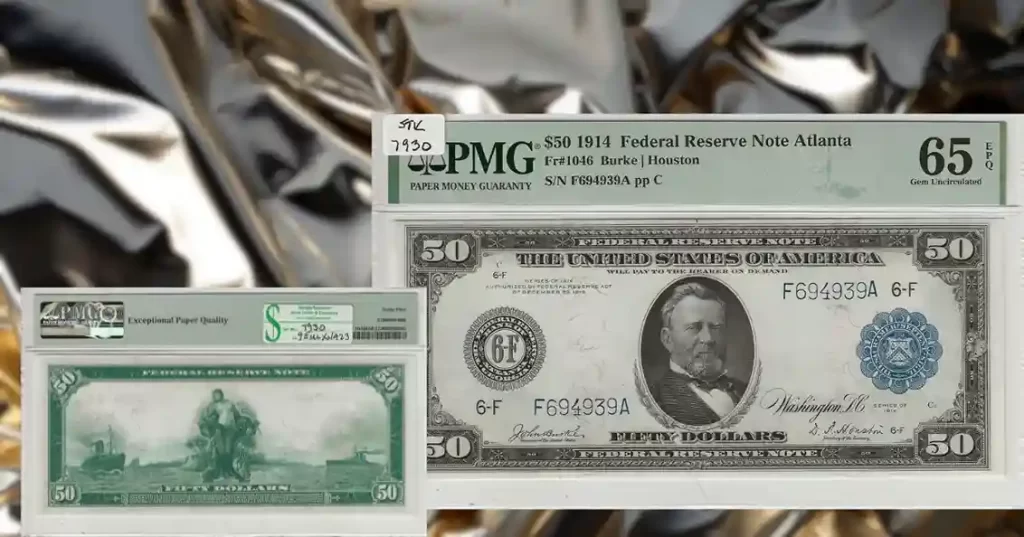

Serial Numbers:

Each note has a unique serial number, which helps to prevent counterfeiting and tracks the bill’s life cycle.

Security Features:

Modern bills incorporate advanced security features like watermarks, security threads, and color-shifting ink to prevent counterfeiting of the notes.

How Federal Reserve Notes are Unique from U.S. Coins:

While Federal Reserve notes are the most widely circulated form of U.S. Currency. The U.S. coins are minted by the U.S. Mint. Unlike notes, coins are mainly composed of metal and are typically used for smaller transactions. Both are considered legal tender, but Federal Reserve notes dominate due to their higher denominations and ease of use in everyday transactions.

The Federal Reserve Note History:

Federal Reserve was officially made in the early 20th century. Before the Federal Reserve Act of 1913, the U.S. did not have a centralized banking system. Different types of currency, such as silver certificates and gold-backed notes, were in circulation. After the Federal Reserve Act, Federal Reserve Banks were established across the country creating a centralized banking system. After some time these banks issued the Federal Reserve Notes.

The Creation of the Federal Reserve:

The Federal Reserve Act of 1913 was proposed in response to the need for a more stable and centralized monetary system. The Federal Reserve was created to regulate the supply of money and maintain economic stability. The Federal Reserve notes were issued as part of this reform and gradually replaced other forms of currency in the country.

Transition from Gold-Backed Notes:

Originally, Federal Reserve notes were backed by gold, meaning that they could be exchanged for gold on demand. This system changed after the Gold Reserve Act of 1934, which made it illegal for U.S. citizens to own gold. Eventually, President Nixon removed the gold standard entirely in 1971. From that point on, Federal Reserve notes became purely fiat currency that has value by government decree, not because it’s backed by a physical commodity like gold or silver.

How Federal Reserve Notes are Made:

The production of Federal Reserve notes is a highly controlled and secure process managed by the U.S. Bureau of Engraving and Printing (BEP). Each note goes through a careful procedure to ensure that it meets the high standards for durability and anti-counterfeiting.

Design:

Each Federal Reserve note begins with a detailed design that includes portraits of prominent historical figures, intricate patterns, and numerous security features.

Printing:

The notes are printed using specialized techniques, such as intaglio printing, which creates raised surfaces on the bill to make it more difficult to counterfeit.

Cutting and Packaging:

Once the sheets of notes are printed, they are cut into individual bills and packaged for distribution to Federal Reserve banks across the country.

The Role of Federal Reserve Notes as Paper Currency:

Federal Reserve notes play a critical role in the U.S. by serving as the primary medium of daily exchange in the country and Global Market. This means they are used in everyday transactions, from buying groceries to paying for services. However, their significance extends far beyond day-to-day purchases.

Monetary Policy and Money Supply:

The Federal Reserve regulates the supply of Federal Reserve notes to maintain economic stability in the country. By controlling the amount of currency in circulation, the Federal Reserve influences inflation rates, employment levels, and the overall health of the economy. This is known as monetary policy.

When the economy is overheating, the Federal Reserve may restrict the supply of money to cool it down and prevent inflation. Conversely, during a recession, the Federal Reserve can increase the money supply to stimulate economic growth.

Global Influence:

Federal Reserve notes are the official currency of the United States, they are used worldwide. A significant portion of U.S. dollars in circulation is held outside of the U.S. Many countries use U.S. dollars as a secondary currency, and some nations even exchange their currency for the dollar to stabilize their economies. These notes are considered the ambassador of the global stock market.

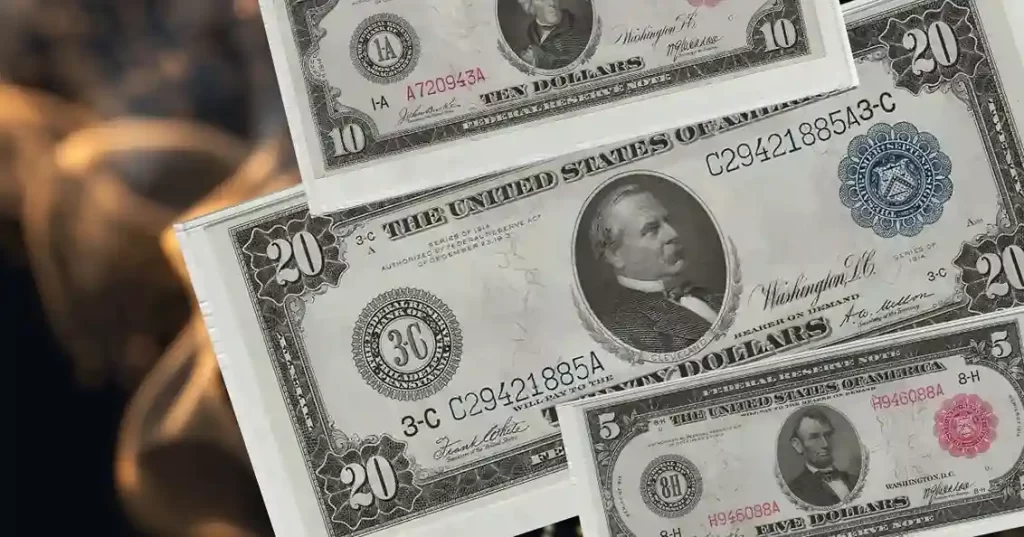

Collecting Federal Reserve Notes:

Most people use Federal Reserve notes for everyday transactions. But some people like to collect them also known as numismatists. Collectors often seek out rare bills, such as those with unusual serial numbers or bills from specific series that are rare and expensive.

Valuable Federal Reserve Notes:

Star Notes:

These are notes that have a small star next to the serial number. They are printed when an error occurs in the original printing run, and the star indicates that the note is a replacement for a defective note.

Low Serial Numbers:

Bills with serial numbers that start with a large number of zeros (e.g., 00000001) are highly collected by collectors.

Older Series:

Notes from early series, such as those printed in the 1920s or earlier, can have high prices depending on their condition and rarity.

How to Identify a Federal Reserve Note:

Identifying a Federal Reserve note is very simple. Understanding their features and markings can provide insights into their origin and significance.

Elements to Look for when identifying an authentic Federal Reserve Note.

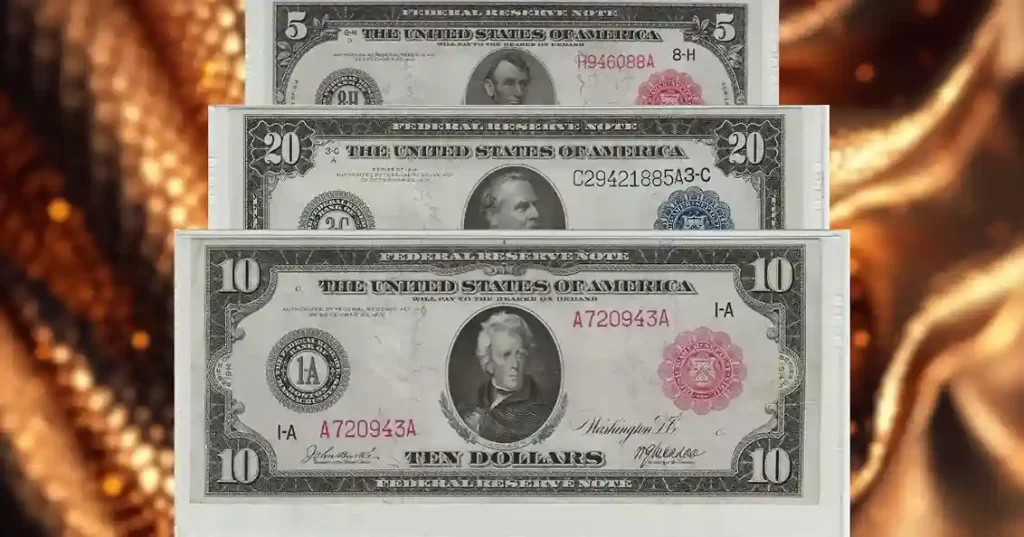

Portrait:

Each denomination features a historical figure, such as George Washington on the $1 bill and Abraham Lincoln on the $5 bill which makes it unique from one another.

Serial Number:

The unique serial number is located in two places on the front of the bill which specifies every note.

Federal Reserve Seal:

The seal of the Federal Reserve Bank that issued the note appears on the left side of the bill.

Treasury Seal:

The Treasury seal, representing the U.S. government, is located on the right side of the note.

By understanding these features, you can quickly recognize a Federal Reserve note and verify its authenticity.

Inflation and the Value of Federal Reserve Notes:

The value of Federal Reserve notes can change due to inflation. As prices rise, the purchasing power of each dollar decreases with the global market. This is why the Federal Reserve closely monitors the economy and adjusts monetary policy as needed to prevent runaway inflation or deflation of currency in the country.

Conclusion:

The Federal Reserve note is much more than just a piece of paper. It is a critical tool in the U.S. economy, backed by the trust and authority of the Federal Reserve. Exploring its history, production, and significance can provide valuable insights into both the U.S. financial system and the broader global economy. Whether you’re using them for daily purchases or collecting rare pieces, Federal Reserve notes are an important part of modern finance.

FAQs

Q1: What makes a Federal Reserve note different from other types of currency?

Federal Reserve notes are now the official paper currency of the United States. Unlike other forms of currency, such as coins or older gold-backed certificates, they are backed by the Federal Reserve.

Q2: Can I exchange a Federal Reserve note for gold?

No, since the U.S. moved from the gold standard in 1971. Federal Reserve notes are now not redeemable for gold.

Q3: Why are some Federal Reserve notes called “Star Notes”?

Star notes are replacement bills printed to replace defective notes during the production process. These notes are marked with a star next to the serial number of the note by the Federal Reserve Bank.

Q4: How does the Federal Reserve control the supply of notes?

The Federal Reserve regulates the supply of notes through its monetary policy tools, influencing inflation and the economic stability of the country.

Q5: What are the most valuable Federal Reserve notes for collectors?

Notes with unique features, such as star notes or low serial numbers, are considered the most valuable among collectors. Their rare features make them highly expensive.