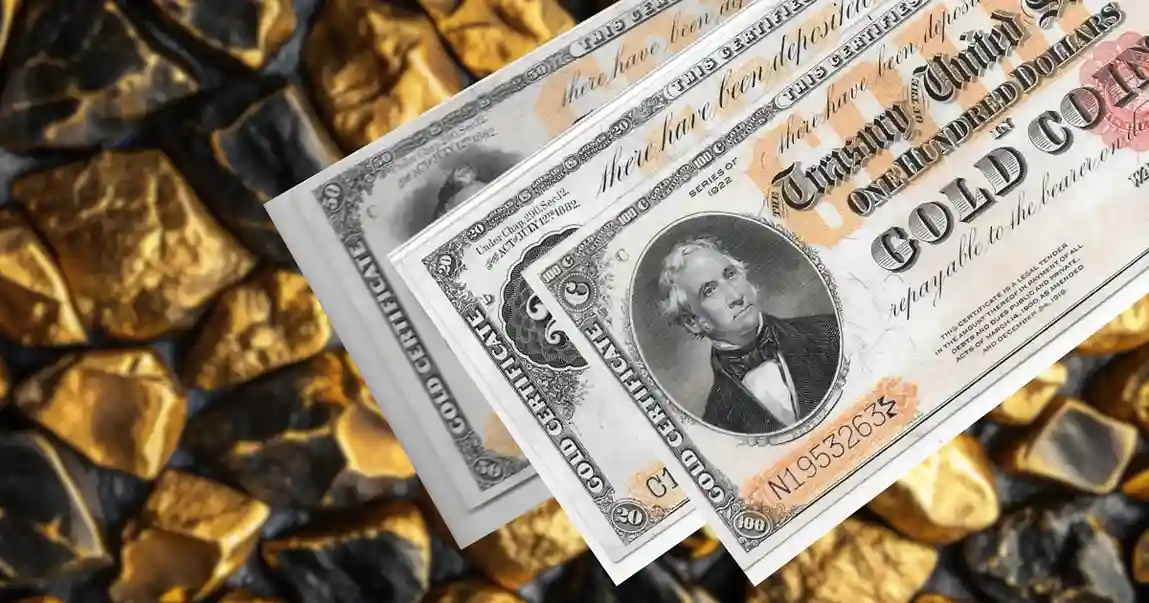

Gold has long been considered one of the most reliable investments, offering security and value. While investing in physical gold remains popular, gold certificate are another way to invest in this precious metal. These historic documents represent ownership of gold without the need to store physical bullion.

As interest in alternative investment options grows, gold certificate regained attention in 2024 because of their historical significance and high value.

What Are Gold Certificates?

The U.S. government first issued gold certificate in the 19th century. They were once a form of paper currency backed by physical gold. Essentially, they functioned like claim checks. The holders of these certificates could exchange them for actual gold held in the U.S. Treasury.

They were introduced as a more convenient way to transact large sums without carrying heavy gold coins or bullion.

In modern times, gold certificate are no longer redeemable for gold, but they hold substantial value in numismatics (currency collecting). Today, these certificates are bought as collectible items with historical significance.

The History of Gold Certificates in the U.S:

The issuance of gold certificates in the U.S. dates back to the Civil War era. Their primary function was simplifying large financial transactions and promoting trust in the currency system.

1863: The U.S. government issued its first gold certificate to help finance the Civil War.

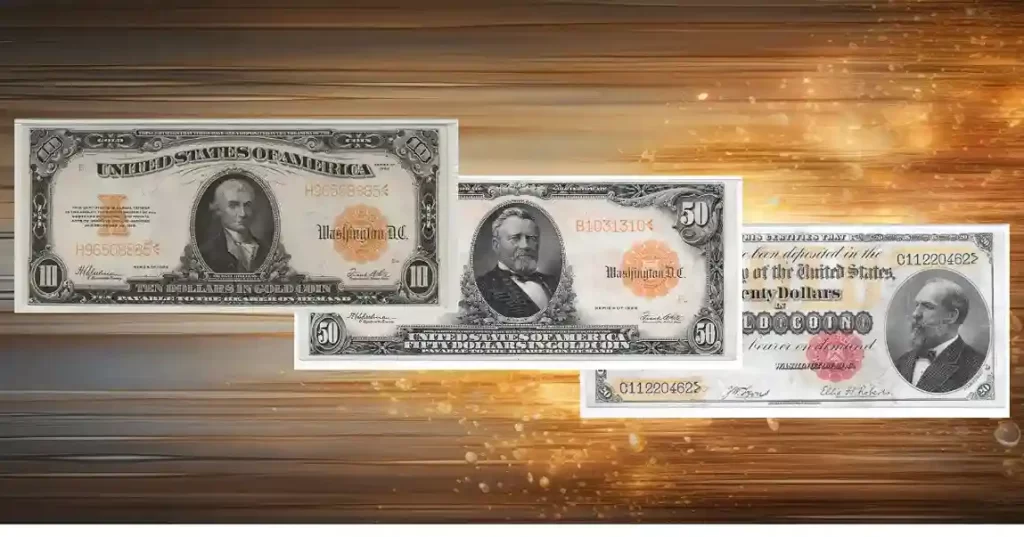

1882: Gold certificates became more standardized, with denominations ranging from $20 to $10,000.

1933: The U.S. ceased the public issuance of gold certificates after the Gold Reserve Act prohibited citizens from owning gold bullion.

1964: The government officially discontinued gold certificates, although they were no longer in active use.

The period between 1933 and 1964 marked the end of gold certificate as a practical form of currency, but it began their legacy as highly valued collectibles.

Why Should You Buy Gold Certificates in 2024?

Gold certificates are gaining renewed interest as we move into the 21st century, particularly for collectors and investors who appreciate these documents’ historical significance and rarity. But is it worth buying gold certificates in 2024? Let’s break down the key reasons.

- Historical Value:

Gold certificates are an essential aspect of the U.S. monetary system’s era. For those who appreciate history, owning a gold certificate is like holding a piece of financial history.

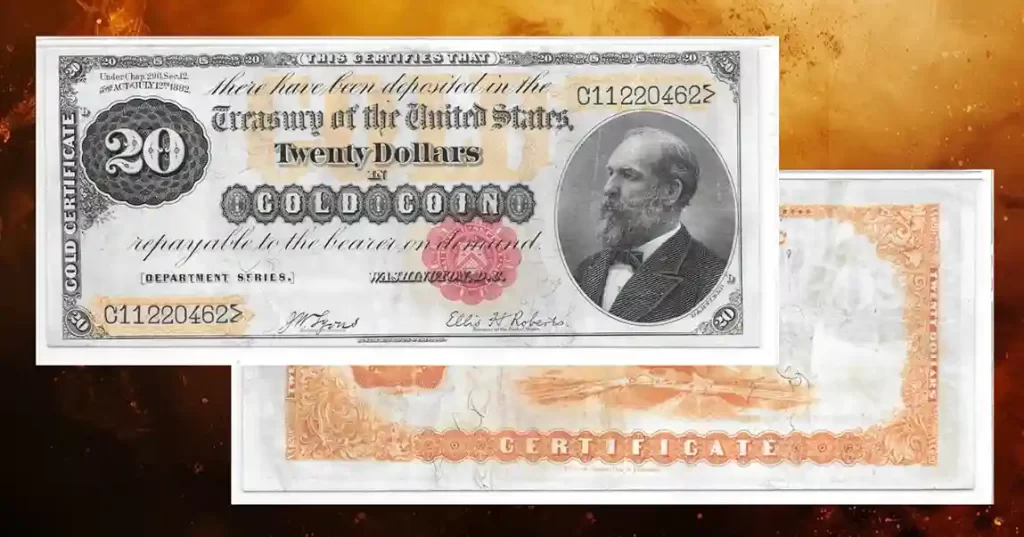

The intricate designs, unique serial numbers, and signatures of Treasury officials make these certificates valuable and visually appealing.

- Rarity and Collectability:

Because gold certificate are no longer issued, they have become increasingly rare. The limited supply, combined with the rising demand for unique collectibles, makes them highly valuable.

In 2024, collectors are particularly interested in certificates with higher denominations ($500, $1,000, and above) and those in pristine condition.

- Store of Value:

While gold certificates are no longer directly redeemable for gold, their value often follows the price trends of gold bullion.

For investors who want to diversify their portfolio with assets tied to gold without having to store physical bullion, gold certificate can be a unique, though speculative, option.

- Alternative to Physical Gold:

Physical gold requires secure storage and comes with concerns like insurance and theft protection. Gold certificate, on the other hand, don’t need safety or security services.

While they no longer grant ownership of actual gold, they still represent an alternative way to hold value linked to the historic U.S. gold standard.

- Potential for Appreciation:

Because of their historical value and scarcity, gold certificate can appreciate over time, especially for rarer issues or those in mint condition.

In 2024, the increasing demand from collectors and investors alike has made gold certificates a potentially lucrative investment.

How to Identify Authentic Gold Certificates:

One of the most critical factors when buying gold certificates is ensuring that they are authentic. Many counterfeit certificates are on the market, so knowing how to spot a real one is essential.

Here are some key features to look for in an authentic gold certificate:

Treasury Seal: Most genuine gold certificate feature a gold-colored Treasury seal.

Serial Numbers: Each certificate has a unique serial number, often printed in distinct fonts.

Denominations: U.S. gold certificate came in various denominations, typically from $10 to $10,000.

Signature: Authentic certificates include signatures from Treasury officials, often including the U.S. Treasury Secretary and the Treasurer.

How Much Are Gold Certificates Worth in 2024?

The value of a gold certificate depends on several factors, such as rarity, denomination, condition, and the market’s interest in historical items. Generally, the higher the denomination and the better the condition, the more valuable the certificate.

Condition: Certificates in uncirculated condition (those that show no signs of wear or folds) command higher prices.

Rarity: The scarcer the certificate, the more value it holds. Some denominations and issues are rarer than others, making them more attractive to collectors.

Age: Older certificates, especially those issued in the 1800s, are more valuable due to their historical significance.

In 2024, the market for gold certificates is thriving, with some rare issues fetching thousands of dollars at auctions. For example, a $1,000 gold certificate in good condition could sell for $10,000 or more, depending on its rarity and demand.

Gold Certificates vs. Gold Bullion: Which Is Better?

Gold certificates and gold bullion offer unique advantages for investors looking to diversify their portfolios. However, they serve slightly different purposes.

Gold Bullion:

It offers direct ownership of physical gold, which can help combat inflation and economic uncertainty. The downside is that bullion requires secure storage and can be challenging to transport.

Gold Certificates:

These documents represent ownership of gold but are not redeemable for the physical metal. They are lighter to store and trade but may not offer the same direct financial security as physical gold. Their value lies more in their collectability than in their intrinsic gold content.

However, gold certificates offer many options for those interested in gold-linked assets’ historical and collectible aspects.

How to Buy Gold Certificates in 2024:

When it comes to buying Gold Certificates, Sanchez Currency is the number one trusted source for quality and authenticity. As a reputable dealer, Sanchez Currency offers an exclusive set of Gold Certificates for collectors and history enthusiasts. If you want to purchase a gold certificate this year, follow these steps to avoid counterfeits.

1. Research: Start by learning about the different types of gold certificates, their history, and the factors influencing their value.

2. Choose a Reputable Seller: To avoid counterfeits, buy from established dealers, auction houses, or certified numismatists like Sanchez Currency.

3. Check for Authentication: Verify that the certificate has been authenticated by a recognized grading service such as PCGS (Professional Coin Grading Service) or NGC (Numismatic Guaranty Corporation).

4. Consider Condition and Rarity: The better the condition and the rarer the certificate, the higher the price. Set a budget based on your priorities.

5. Track Market Trends: Monitor the price of gold and the demand for rare collectibles to understand how your investment may perform over time.

FAQs

Q1: Are gold certificates still redeemable for gold?

No, gold certificates have not been redeemable for physical gold since 1933, following the Gold Reserve Act.

Q2: How much can a gold certificate be worth?

The value varies based on the certificate’s condition, rarity, and denomination. Standard certificates may be worth several hundred dollars, while rare, high-denomination certificates can cost thousands.

Q3: Are gold certificates a good investment in 2024?

Gold certificates are a good investment for collectors and investors interested in historical items. Their value is appreciated over time, especially as they become rarer.

Q4: Where can I buy gold certificates?

You can purchase gold certificates from reputable currency dealers, auction houses, or online numismatic platforms. Always buy from trusted sources to avoid counterfeits.

Q5: Can gold certificates lose value?

Like any collectible, gold certificates’ value can fluctuate based on market demand, gold prices, and the item’s condition. However, rare and well-preserved certificates tend to be appreciated over time.