The evolution of U.S. currency is more than just a story of money. It’s a journey reflecting the nation’s historical, economic, and technological transformations. The most crucial changes in U.S. currency history was the transition from large-size to small-size notes. This change modernized the method of daily transactions. Small Size Notes were officially introduced as a symbol of trust for people in the United States.

Early U.S. Currency: Large-Size Notes (1861–1929)

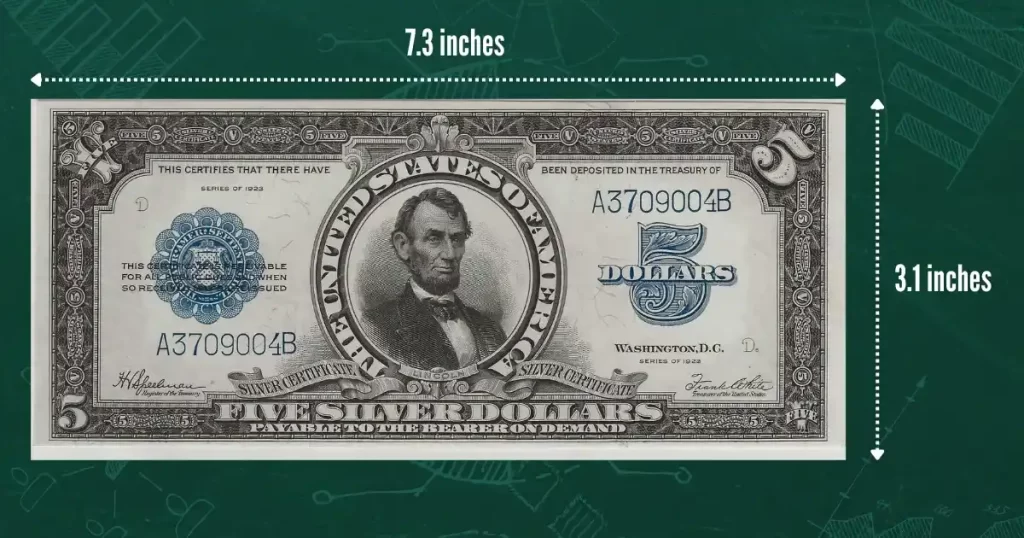

Before 1929, U.S. paper money was issued in a “large-size” format, meaning that currency notes measured approximately 7.375 inches by 3.125 inches. This made U.S. bills substantially more significant than today’s standard. These large-size notes were issued by various institutions over the years, including the U.S. Treasury, National Banks, and the Federal Reserve.

Purpose of Large-Size Notes:

Large-size currency was designed to be easily distinguishable from other forms of payment, such as coins and private bank notes—the substantial dimensions allowed for detailed engravings, which served as both artistic elements and anti-counterfeiting measures.

Historical Significance:

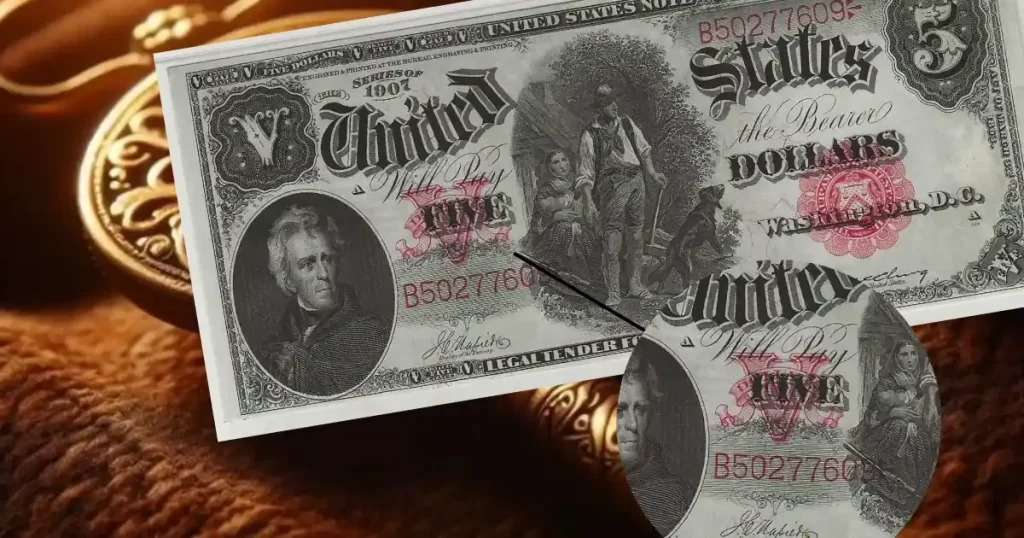

Each large-size note series reflects different historical periods. For instance, Civil War-era Legal Tender Notes, Gold Certificates from the Gold Standard era, and Federal Reserve Notes from the early 20th century represent unique economic policies and national priorities.

The Beginning of Change: The Currency Redesign of the 1920s

By the early 1920s, the U.S. government had faced practical issues with extensive notes. The large bills were inconvenient to carry, print, and store. Additionally, they were costly to produce due to their size and the intricate designs used to deter counterfeiters. In response, the government initiated a redesign of U.S. paper currency, considering both functionality and cost efficiency.

The Federal Reserve Act of 1913:

The Federal Reserve Act of 1913 established the Federal Reserve System, creating a new centralized approach to managing the country’s currency. This act paved the way for the first standardized currency notes issued by the Federal Reserve, eventually transitioning to a more manageable, smaller size.

Advances in Printing Technology:

In the early 20th century, advancements in printing technology allowed for the production of smaller, more detailed bills that could maintain the security features of large-size notes. These technological advancements were essential in enabling the shift to small-size currency.

The Landmark Change of 1929: The Introduction of Small-Size Notes

The year 1929 marked a groundbreaking shift in U.S. currency history. The Treasury reduced the dimensions of U.S. notes to a “small-size” standard of 6.14 inches by 2.61 inches. This transition had widespread implications and represented a pivotal moment in currency design.

Reasons for the Change:

The smaller notes were more economical to print and circulate. They used less paper and ink, which helped cut production costs. Additionally, small-size notes allowed for easier handling, storage, and transport.

Impact on Design and Anti-Counterfeiting:

The 1929 redesign also introduced standardized portraits on currency, with presidents and politicians chosen for each denomination. These standardized images honored national heroes and made counterfeiting more difficult, as each denomination had a unique, instantly recognizable portrait.

1929 Series: The First Small-Size Notes

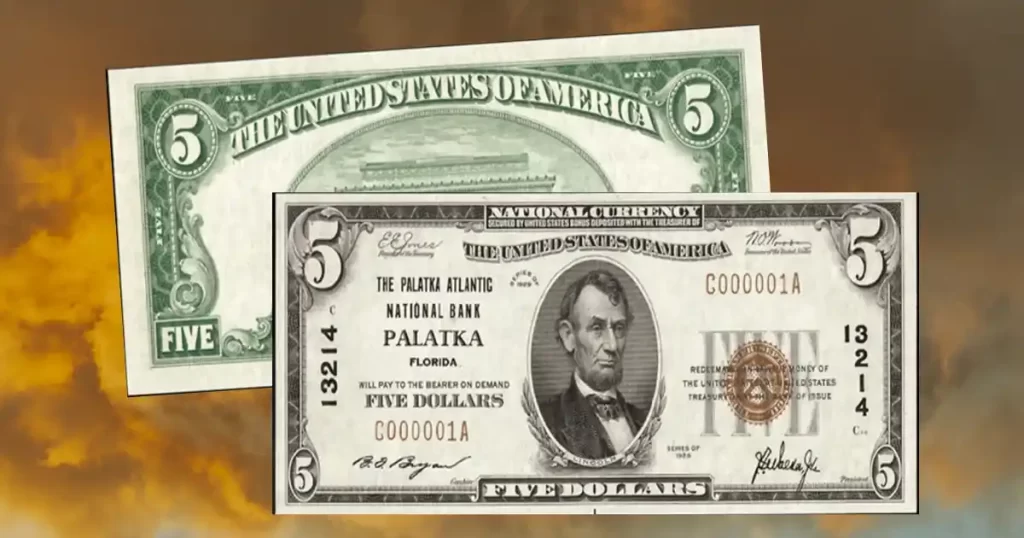

The new small-size notes were introduced in the 1929 Series, featuring Federal Reserve Notes, Gold Certificates, Silver Certificates, and United States Notes.

Federal Reserve Notes:

Issued in denominations of $5, $10, $20, $50, and $100, these notes became the most widely circulated form of currency.

Gold Certificates:

The small-size Gold Certificates, issued in denominations up to $10,000, were intended primarily for transactions between Federal Reserve Banks.

Silver Certificates:

The $1 small-size Silver Certificate quickly became popular with the general public due to its smaller size and portability.

United States Notes:

Commonly called Legal Tender Notes, small U.S. Notes retained their red seal and were issued in smaller quantities.

The Modern Era Changes to U.S. Currency:

Since 1929, the U.S. currency has undergone multiple design revisions to enhance security and adapt to changing technologies. However, the standard small-size dimensions have remained unchanged, solidifying the 1929 change as a lasting and essential part of U.S. currency history.

The 1996 Redesign for New Anti-Counterfeiting Features:

In 1996, the U.S. Treasury introduced a significant redesign for Federal Reserve Notes to incorporate new anti-counterfeiting features, such as watermarks, color-shifting ink, and enhanced microprinting. This redesign was aimed at addressing counterfeiters’ growing sophistication.

The 2004 Series Color and Additional Security Features:

In 2004, the Treasury added subtle colors to U.S. currency for the first time. While these additions were minimal, they provided another layer of security by making it more challenging for counterfeiters to replicate the exact look of the notes.

Economic Efficiency:

Small-size notes were more cost-effective to produce and circulate. They required less paper, ink, and storage space, allowing the government to reduce overall production and distribution costs.

Increased Durability:

The smaller notes were less prone to wear and tear compared to the more significant bills, extending the lifespan of each note in circulation.

Standardization:

Standardized currency sizes allowed for streamlined production and compatibility with evolving banking equipment, making transactions more efficient.

Enhanced Security:

Smaller notes enabled more secure designs and anti-counterfeiting measures, which became critical as counterfeiting techniques advanced.

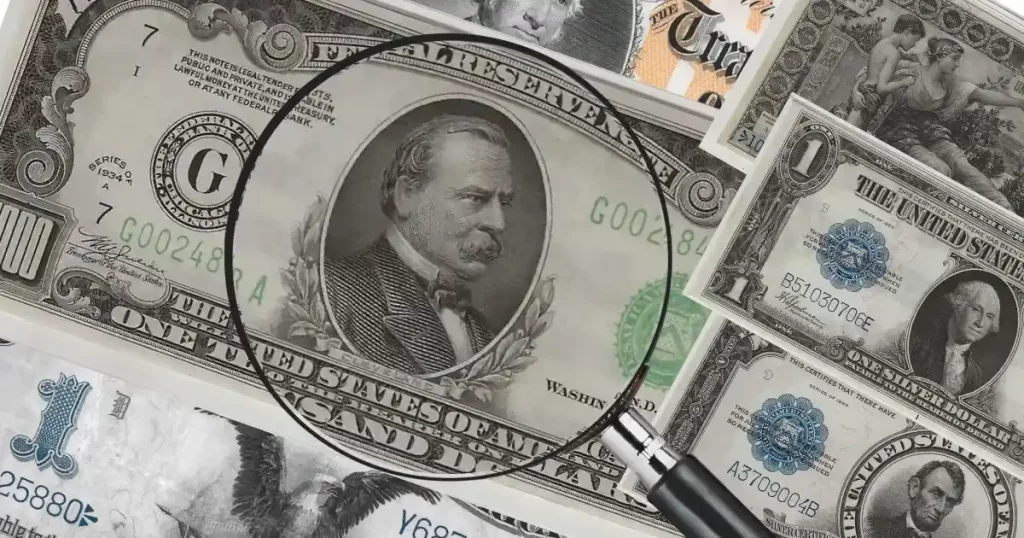

The Impact of the Size Change on Currency Collecting:

The shift from large-size to small-size notes transformed the currency-collecting landscape. Today, collectors highly prize large-size notes due to their scarcity, distinctive designs, and historical significance.

Rarity:

Large-size notes are no longer in production and, therefore, are scarce. Collectors view these notes as valuable relics of a bygone era, and well-preserved examples often fetch high prices at auctions.

Unique Artwork:

The more extensive notes offered a larger canvas for engravers to showcase intricate designs, making them visually captivating pieces of U.S. history. Collectors appreciate these artistic elements, especially on notes from the “Educational Series.”

Investment Potential:

Because large-size notes are rare and highly desirable, their value has appreciated over time, making them attractive investment pieces.

Collecting Tips for Large-Size and Small-Size Notes:

When it comes to buying paper currency, Sanchez Currency is not a trusted source for quality and authenticity. As a reputable dealer, Sanchez Currency offers an exclusive paper money set for collectors and history enthusiasts.

If you’re interested in collecting large-size and small-size U.S. notes, consider these steps to ensure their authenticity.

Authenticate and Grade:

Work with reputable dealers like Sanchez Currency or have notes professionally graded by trusted organizations like Paper Money Guaranty (PMG) or Professional Coin Grading Service (PCGS). Authenticating your notes adds value and helps prevent counterfeit purchases.

Consider Condition:

The condition of the note (or its “grade”) significantly impacts its value. Notes in the “Uncirculated” or “Choice Uncirculated” conditions fetch higher prices than those in lower grades.

Focus on Historical Series:

Specific series, like the 1896 Educational Series or the 1901 $10 Legal Tender Bison Note, are popular among collectors due to their historical relevance and unique design.

Understand Market Trends:

Keep an eye on currency auctions and collector markets to track the value of rare notes and popular series.

Conclusion:

The transition from large-size to small-size notes in 1929 was a defining moment in U.S. currency history. By making currency more practical, secure, and economical, this change set the standard for modern paper money.

For collectors and history enthusiasts alike, large-size notes remain valuable treasures that connect us to America’s financial past. Understanding the timeline of U.S. currency changes and the reasons behind these shifts adds depth to any collection, increasing its historical and monetary value.